Do what you love and you’ll never work a day in your life. While Confucius is credited with coining this phrase, it’s something that is brought to life by hundreds of thousands of American entrepreneurs each day. In addition to the business greats that come to mind, the truth of the matter is that the majority of the 783,183 business owners are just like you and I.

They have a passion for something. They spent time researching and planning and trying to figure out the perfect blend of products, services, or both, for their target audience. They most likely typed into Google at one point or another: “How to become a business owner.” Or, like me, they searched “how to become a successful business owner” and “what does it take to be successful as a business owner.

The results weren’t surprising: business savvy, education, financial knowledge, daily habits, and mindset are all among the basic drivers for most small business owners’ success. When I started my own financial services firm in 2005, I thought I was prepared with all of these skills. Looking back on that time almost 20 years later, I’ve never been more sure that everything you encounter as a business owner is a prompt to grow and challenge, no matter the setbacks.

And, like any journey in life, the most important step is the first one.

Here’s everything I wish I’d known when I started my ClearWater Wealth Management all those years ago:

Step 1: Identifying Your Business Idea

The journey to becoming a business owner starts with a spark of inspiration. It’s that “aha” moment when you recognize a problem or an unmet need in the market, and you have a vision for how to address it. This is where your entrepreneurial journey truly begins.

It’s essential to nurture and develop this initial idea, as it will serve as the driving force behind your business. What’s your big idea? What is it about your concept that sets it apart from the rest? Take the time to delve deep into your thoughts, brainstorm, and refine your concept.

Once you’ve honed your business idea, it’s time to consider your product or service offerings. What will you bring to the world, and how will it solve the problem you’ve identified? Your offerings should provide value and address the needs of your target market.

Step 2: Conduct Market Research

Step 2: Conduct Market Research

Thorough market research is an indispensable step in the journey of becoming a successful small business owner here. It serves as your compass, pointing you in the right direction and helping you make informed decisions. Through research, you gain a deep understanding of your potential customers’ preferences, pain points, and expectations. By delving into the market, you unearth valuable insights that can shape your business strategy and offerings.

Understanding your target market’s preferences is crucial because it allows you to align your products or services with their tastes and needs. This alignment not only increases the chances of attracting and retaining customers but also sets you apart from competitors who may not be as attuned to their audience. You can use surveys, focus groups, or online analytics to gather data on consumer behavior and preferences, helping you tailor your offerings to meet or exceed their expectations.

Market research also provides a window into the pain points your potential customers face. These are the challenges and frustrations they encounter in their daily lives that your business can address. By identifying these pain points, you can design solutions that genuinely alleviate their problems, positioning your business as a valuable resource. This customer-centric approach not only fosters loyalty but also fosters word-of-mouth recommendations, a powerful driver of business growth.

Moreover, market research helps you understand the expectations of your target audience. What do they expect from businesses and companies in your industry? What level of quality, service, or pricing are they accustomed to? Armed with this knowledge, you can set realistic benchmarks and deliver on customer expectations. This ensures that your business is well-received from the start, building a positive reputation and establishing trust within your market niche.

Step 3: Craft a Comprehensive Business Plan

Step 3: Craft a Comprehensive Business Plan

A well-structured business plan is not just a document; it’s your roadmap to success as a small business owner. It serves as a comprehensive guide that outlines your business’s mission, vision, and core values. In this plan, you’ll clearly define your business goals and objectives, which act as the guiding stars to steer your efforts in the right direction. Having these objectives in writing keeps you and your team focused, motivated, and aligned towards achieving the same vision.

Financial projections are another crucial component of your business plan. Here, you’ll lay out your revenue forecasts, expenses, and profit margins. These numbers are not just for investors or lenders; they are essential for your own strategic decision-making. Accurate financial projections provide insights into the feasibility of your business idea, helping you identify potential challenges and opportunities well in advance.

Your business plan is also where you’ll address vital aspects like your chosen business structure, funding options, and marketing campaigns. The choice of business structure, whether it’s a sole proprietorship, LLC, or partnership, has legal and financial implications, and your plan will provide a clear rationale for your selection.

Funding options, such as loans, grants, or bootstrapping, are critical to your business’s financial health, and your plan will detail how you intend to secure and utilize these resources. Additionally, your marketing campaigns and strategies will be outlined, showing how you’ll reach your target audience, build brand awareness, and ultimately drive sales.

Step 4: Choose the Right Business Structure

Step 4: Choose the Right Business Structure

Choosing the right legal structure for your business is a pivotal decision that can have far-reaching implications for your entrepreneurial journey. Each option, whether it’s a sole proprietorship, limited liability company (LLC), or general partnership, comes with its unique set of advantages and disadvantages, making it crucial to carefully weigh your choices.

A sole proprietorship is the simplest and most common form of business ownership. While it offers complete control over own business and is easy to set up, it also means that you and your business are legally considered the same entity. This entails personal liability for business debts and legal issues, which can put your personal assets at risk.

On the other hand, forming an LLC provides a level of personal liability protection. It creates a legal distinction between you and your business, shielding your personal assets from business debts or lawsuits.

General partnerships involve shared ownership with one or more individuals, and they also lack personal liability protection. Each partner is personally responsible for the business’s debts and obligations.

However, partnerships can be advantageous for small businesses in terms of pooling resources and skills. It’s essential to have a well-defined partnership agreement that outlines each partner’s responsibilities, profit-sharing, and dispute resolution mechanisms to avoid potential conflicts down the road.

Step 5: Register Your Business and Secure Necessary Permits

Giving your business a unique and memorable name is a crucial step in establishing your brand identity. Your business name should resonate with your target audience and convey the essence of your products or services. It’s the first impression you make on potential customers, so take your time to brainstorm and choose a name that stands out.

Additionally, conduct a thorough search to ensure that your desired business name is legally available. This means checking trademark databases and business registries to avoid any potential trademark conflicts or legal issues down the road. Securing a unique and legally clear business name is a foundation for building a strong brand presence.

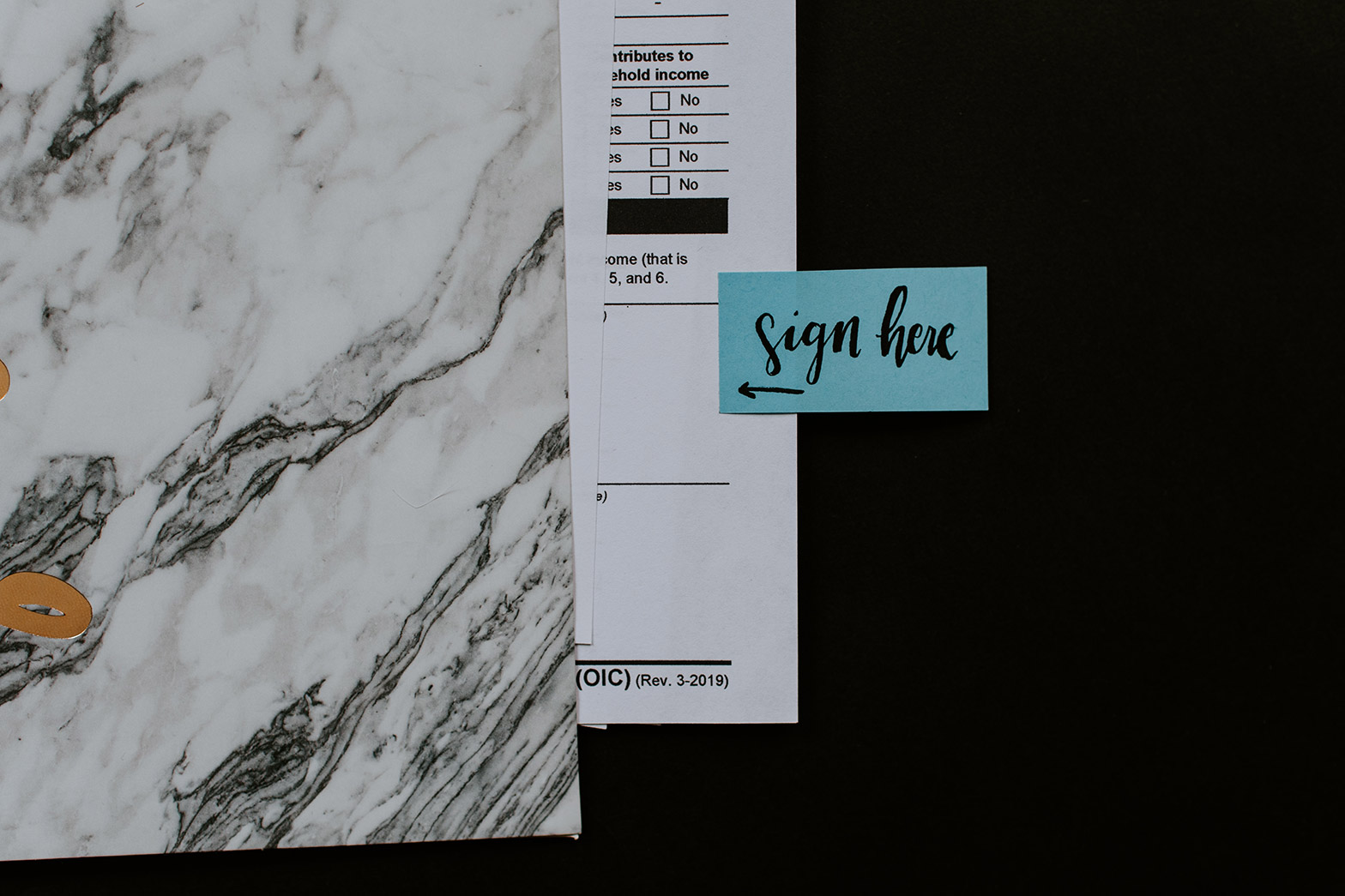

Once you’ve settled on the perfect name, it’s time to register your business with the appropriate authorities. The registration process varies depending on your chosen legal structure and your location. Sole proprietorships and partnerships may have fewer formal registration requirements, while LLCs and corporations typically require more paperwork. It’s crucial to follow all legal procedures and submit the necessary documentation to ensure your business operates within the bounds of the law.

In addition to registering your business, you may need to obtain various licenses and permits, depending on your industry and location. These permits can include business licenses, health permits, zoning permits, and more.

Step 6: Develop Essential Skills

Step 6: Develop Essential Skills

I think this is my favorite category because it underscores the importance of personal growth and the continuous pursuit of excellence. In the world of entrepreneurship, where every day can bring new challenges and opportunities, honing your skills is not just an option; it’s a necessity.

While industry-specific knowledge is undoubtedly essential, it’s the soft skills that often make the difference between success and mediocrity in many small business owners. Self-motivation is the driving force behind your entrepreneurial spirit. It’s what gets you out of bed in the morning, fuels your determination, and keeps you pushing forward, even in the face of adversity. Cultivating this inner drive is a lifelong journey, but it’s one that will serve you well as you navigate the ups and downs of running a business.

Time management is another critical skill that successful business owners everywhere must master. In the entrepreneurial world, time is a finite and valuable resource. Efficiently managing your time allows you to maximize productivity, prioritize tasks effectively, and strike a balance between work and personal life. It’s about making the most of every hour, day, and week to achieve your business goals without burning out.

Work-life balance is the final piece of the puzzle. As a business owner, the lines between work and personal life can easily blur, but it’s essential to establish boundaries that preserve your well-being. Achieving this balance ensures that you not only succeed in your business endeavors but also maintain your physical and mental health. It’s a skill that requires ongoing attention and adjustment, but it’s crucial for your long-term happiness and sustainability as an entrepreneur.

Step 7: Secure Funding and Financial Stability

Securing adequate capital is a fundamental requirement for any business’s growth and sustainability. Your choice of funding options can significantly impact your business’s trajectory and success.

One of the most common sources of initial capital is using your personal funds, often referred to as “bootstrapping.” This approach can provide a sense of independence and control, but it also carries personal financial risks. Bootstrapping for money may be suitable for businesses with low startup costs or those in the early stages of development. However, it may not provide the necessary resources for rapid expansion or scaling.

Seeking investors or loans is another avenue to consider. Investors can provide not only funding but also valuable expertise and connections. However, attracting investors often requires a well-defined business plan and a compelling value proposition. Loans, on the other hand, can be obtained from banks, online lenders, or through government programs. While loans offer financial flexibility, they come with the responsibility of repayment, including interest. Assessing the cost of borrowing versus the potential returns on investment is critical when opting for loans.

The choice of funding option should align with your industry, business type, and growth potential. Industries with high capital requirements, such as technology or manufacturing, may necessitate seeking venture capital or angel investors.

Conversely, service-based businesses with lower overhead costs may find bootstrapping or smaller loans more suitable. Regardless of the path you choose to pursue, maintaining financial stability is crucial for long-term success. This involves prudent financial management, budgeting, and monitoring cash flow. A financially stable business is better equipped to weather unexpected challenges, seize growth opportunities, and achieve its long-term goals

In Conclusion

Remember that entrepreneurship is a journey, not a destination. And sometimes the first step is the hardest one to take. Beyond that, the path is one filled with learning experiences, challenges, and opportunities for growth.

What you thought would happen when you first researched how to become a successful small business owner most likely will pivot and adjust over time, which I honestly think is part of the fun. So, start with that spark of inspiration, nurture it, and watch as it ignites the flames of your entrepreneurial spirit, propelling you toward success.

Related Posts

7 Reasons Why Professional Development Is Important

How to Create The Ultimate Self-Care Plan

7 Secrets to Becoming a Better Employee